Table of Contents

- Calendar 2026 Template Planner 2026 Year Wall Calendar 2026 Template ...

- Annual Calendar Template 2026 Year Week Stock Vector (Royalty Free ...

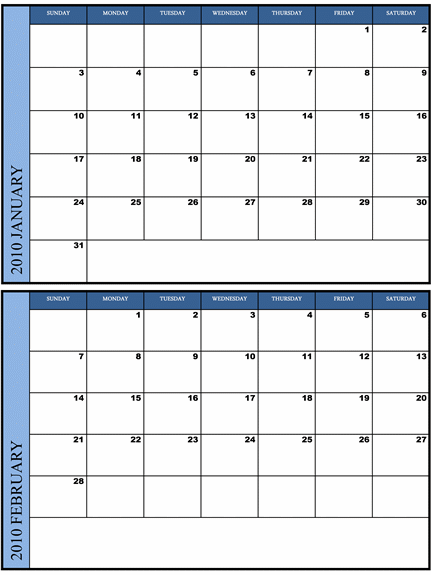

- Daily, Weekly, Bi Weekly Calendar 2024 Template in Excel, Google Sheets ...

- Calendar 2026 blank template clean and minimal design size A4, Week ...

- Calendar 2026 blank template clean and minimal design size A4, Week ...

- Premium Vector | Vector calendar for 2026 on a white background week ...

- Free Printable Bi Monthly Calendar Templates - 2024 CALENDAR PRINTABLE

- Premium Vector | Simple calendar 2026 template week number week start ...

- Premium Vector | Simple modern calendar 2026 template Week number Week ...

- Premium Vector | Calendar 2026 blank template clean and minimal design ...

What are Payroll Calendar Templates?

Benefits of Using QuickBooks Payroll Calendar Templates

Features of QuickBooks Payroll Calendar Templates for 2025-2026

QuickBooks payroll calendar templates for 2025-2026 offer a range of features, including: Pre-designed templates: Choose from a range of pre-designed templates that are tailored to your specific business needs. Customizable: Easily customize the template to fit your business's unique payroll schedule and needs. Integrates with QuickBooks: Seamlessly integrate the template with your QuickBooks accounting software. Automatic calculations: The template will automatically calculate pay periods, pay dates, and deadlines, reducing the risk of errors.